The Indian stock market started September on a positive note as the Nifty 50 closed at 24,625.05 on 1 September 2025, gaining 198 points (0.81%). This rise came after three consecutive sessions of decline, bringing fresh optimism for investors.

🔑 Key Market Drivers on 1 September

Strong GDP Growth: India’s Q1 FY26 GDP expanded 7.8%, the highest in five quarters, boosting overall market sentiment.

Sectoral Leadership: Auto stocks like Bajaj Auto, M&M, Royal Enfield and IT majors led the rally.

Broad Participation: Mid-caps and small-caps also outperformed, while India VIX (volatility index) eased, indicating reduced fear.

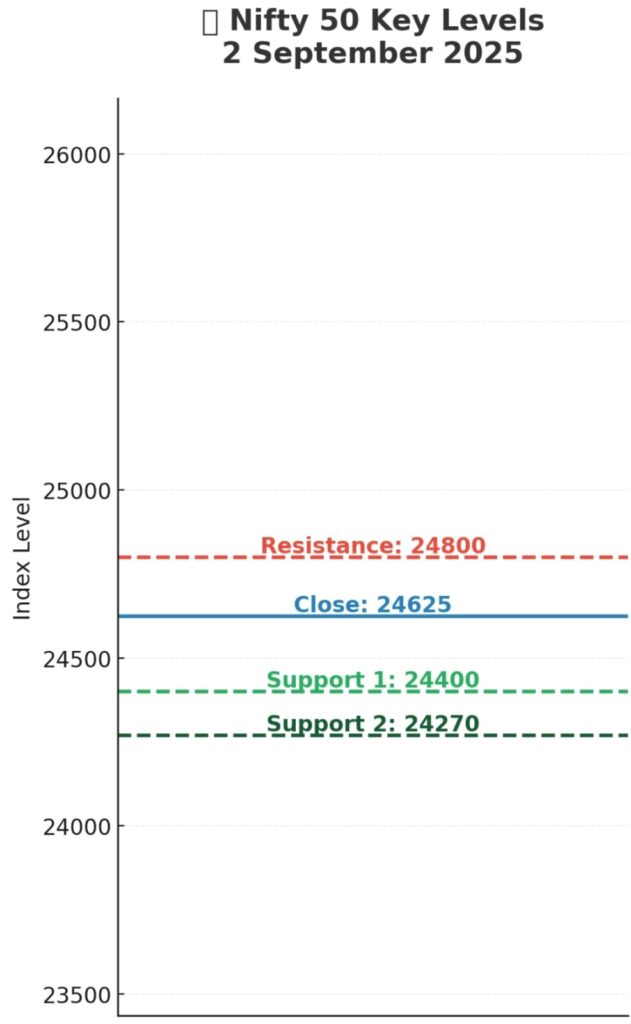

📈 Technical Outlook for 2 September 2025

Resistance: 24,800 remains the key hurdle.

Support: First support lies at 24,400, with stronger support near 24,270 (200-day EMA).

Trend: Nifty is slightly oversold; analysts expect a “sell on rise” strategy to be effective near the 24,720–24,730 zone.

📅 Historical Sentiment in September

September has often been a weak month for Indian equities, but the strong macroeconomic backdrop this year—especially the GDP surprise—may help Nifty defy seasonal weakness.

🎯 Outlook for 2 September 2025

The Nifty is likely to open firm near 24,600–24,650.

Upside potential: If momentum continues, the index could move towards 24,800.

Downside risk: A break below 24,400 may trigger further declines toward 24,270.

✅ Conclusion

The market enters September with renewed optimism, supported by robust economic growth and sectoral strength in IT and Auto. For traders, the 24,400–24,800 range will be crucial on 2 September 2025. Investors should stay cautious, monitor global cues, and adjust positions accordingly.

Leave a Reply