The Indian stock market closed the week on a strong note with the Nifty 50 ending above 25,100, extending its winning streak to eight consecutive sessions — the longest in nearly a year. Investors are now eyeing Monday’s opening with expectations of whether this bullish momentum will continue or if a near-term pullback is on the horizon.

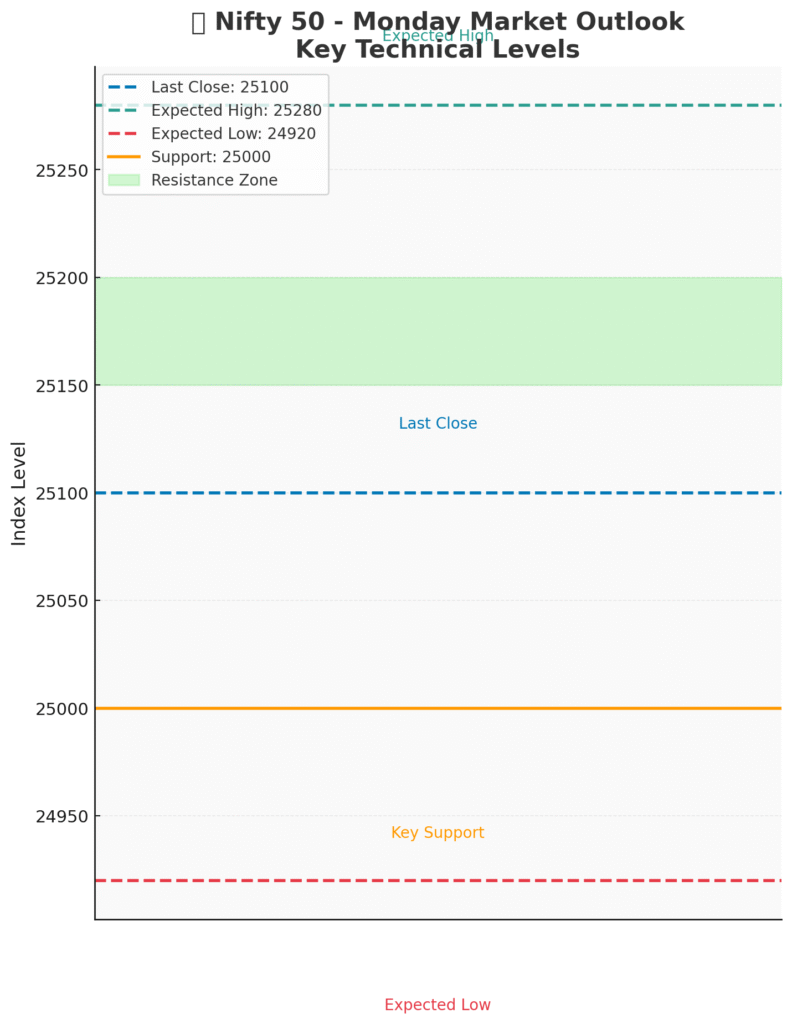

📊 Key Technical Levels

- Resistance Zone: 25,150 – 25,200

- Bullish Target (if momentum continues): 25,500 – 25,700

- Support Zone: 25,000 (break below may trigger downside to 24,800)

The index has recently broken out of a descending channel, which gives bulls a strong technical setup. However, given the sharp run-up, profit-taking around resistance levels cannot be ruled out.

⚡ What Could Drive Monday’s Trade?

- Global Cues: US Federal Reserve commentary, bond yields, and crude oil movement remain critical.

- Foreign Portfolio Investors (FPIs): Recent outflows have capped gains; any reversal may fuel further upside.

- Rupee vs Dollar: A weakening INR could pressure import-heavy sectors, while exporters may benefit.

- Sector Watch: Banks, IT, and Metals are likely to be the key drivers on Monday.

📈 Expected Intraday Range

Based on recent volatility (average daily swing ~200 points):

- Expected Low: ~24,920

- Expected High: ~25,280

Holding above 25,100 will keep the bullish tone intact. A breach of 25,000, however, may open the door for consolidation or a deeper pullback.

✅ Outlook Summary

- Bullish Scenario: Sustained trade above 25,150 could push Nifty toward 25,500+ in the short term.

- Neutral Scenario: Consolidation between 25,000 – 25,200 likely if global cues remain mixed.

- Bearish Scenario: A decisive fall below 25,000 could drag Nifty back to 24,800 or lower.

💡 Bottom line: The Nifty remains in a bullish setup, but traders should closely watch the 25,000–25,200 zone for direction. Monday’s open and global sentiment will set the tone for the week ahead.

Leave a Reply